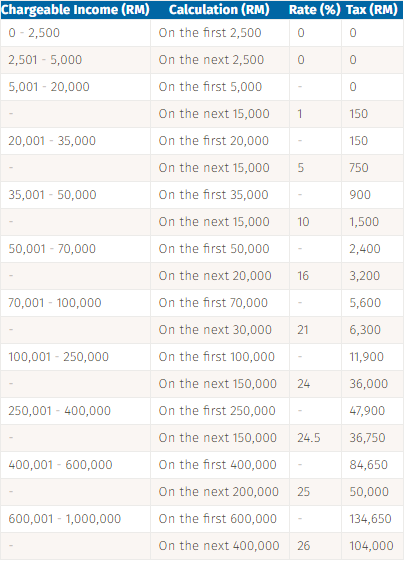

Resident Individual Tax Rates for Assessment Year 2018-2019. In 2018 some individual tax rates have been slashed 2 for three slabs Chargeable Income Bands 20001-35000 35001 50000 50001 -70000 will now be taxed 3 8 14 respectively.

Thailand S New Personal Income Tax Structure Comes Into Effect Asean Business News

13 September 2018 Page 2 of 14 Tax on the balance XX of chargeable income XX XX.

. Income tax rates 2022 Malaysia. No tax is payable if total income under salaries does not exceed MMK 48 million a year. Self Dependent 9000 2.

The decision on how much of the individual income tax revenue needed be paid are decided on every years budget meeting in Parliament. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. Based on this table there are a few things that youll have to understand.

You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Income Tax Rates and Thresholds Annual Tax Rate. Yes if you have your very own medical insurance policy you can claim medical expenses when you file for your income tax.

Basic supporting equipment for disabled self spouse child or parent 6000. 1 Corporate Income Tax 11 General Information Corporate Income Tax. Introduction Individual Income Tax.

Malaysia implemented e-filing some years ago and it is important to note that taxpayers have now preferred to submit their income tax returns through e-filing. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file. You can check on the tax rate accordingly.

Offences Penalties Failure to furnish Income Tax Return RM200 to RM20000 or imprisonment or both on conviction or 300 of tax payable in lieu of prosecution Failure to furnish Income Tax Return for 2 YAs or more RM1000 to RM20000 or imprisonment or. The personal income tax with the highest rate is only 27. Accurate and easy calculation to Malaysian tax payers to calculate PCB that covers all basic tax relieves such as individual.

Assessment Year 2018-2019 Chargeable Income. Those who stay less than that are non-residents and will be taxed differently. Below are the Individual Personal income tax rates for the Year of Assessment 2021 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN Malaysia.

Chargeable Income Calculations RM Rate TaxRM 0 - 5000. On the First 5000. Under the tax law those who stay more than 182 days in Malaysia are considered residents.

Here are the tax rates for personal income tax in Malaysia for YA 2018. 20182019 Malaysian Tax Booklet Personal Income Tax. Also taxes such as estate duties earnings tax yearly wealth taxed or federal taxes do not get levied in Malaysia.

This relief is applicable for Year Assessment 2013 and 2015 only. Understanding tax rates and chargeable income. Resident nationals and foreigners.

Malaysia Personal Income Tax Guide 2018 YA 2017 Question 6. Malaysia Non-Residents Income Tax Tables in 2019. The Simple PCB calculator takes into account of RM2000 special tax relief limit that capped at income RM8000mth.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. Chargeable income is your taxable income minus any tax deductions and tax relief.

Individual - Significant developments. Malaysia Personal Income Tax Rate. A non-resident individual is taxed at a flat rate of 30 on total taxable income.

Personal income tax in Malaysia is charged at a progressive rate between 0 28. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website. First of all you have to understand what chargeable income is.

Offences under the Income Tax Act 1967 and the penalties thereof include the following. Can I Claim Medical Expenses On My Taxes. Medical Expenses for Parents OR Parent Limited 1500 for only one mother Limited 1500 for only one father 5000 limited OR 3000 limited 3.

Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share. Assessment Year 2018 Assessment Year. Individual Life Cycle.

The following list illustrates the income tax rate for each taxable income group from the year 2010 assessment onwards. However there is a grace period or an extended deadline for e-filing till May 15th. Calculations RM Rate TaxRM 0 - 5000.

Capital gains tax. Monthly Tax Deduction 2018 for Malaysia Tax Residents optionname00. Types of Contribution allowed for Personal Tax Relief Individual Relief Types Amount RM 1.

50 income tax exemption on rental income of residential homes. 43 For a resident individual income tax shall be charged upon the chargeable income of the individual at the scale rate as specified in Schedule 1 of the. The e-filing system is open from March 1st every year to April 30th.

Corporate tax rates for companies resident in Malaysia is 24. Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020. 20182019 Malaysian Tax Booklet 21 year and in any 3 of the 4 immediately preceding years he was in Malaysia for at.

Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except. 62018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. For this you get an income tax relief of RM3000 for medical insurance so make full use of it and get.

How To Calculate Foreigner S Income Tax In China China Admissions

Gst In Malaysia Will It Return After Being Abolished In 2018

Here Are The Tax Reliefs M Sians Can Get Their Money Back For This 2018 World Of Buzz Tax Relief Income Tax

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Provision For Income Tax Definition Formula Calculation Examples

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

How To Calculate Income Tax In Excel

Singapore Tax Rate Personal Individual Income Tax Rates In Singapore Updated

Tax Rates Of Nordic Countries World Europe And Oecd Countries 4 Download Scientific Diagram

7 Tips To File Malaysian Income Tax For Beginners

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

How To Calculate Income Tax In Excel

Poland Personal Income Tax Rate 2021 Data 2022 Forecast 1995 2020 Historical

What Happens When Malaysians Don T File Their Taxes Update

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Income Tax Malaysia 2018 Mypf My

Cukai Pendapatan How To File Income Tax In Malaysia